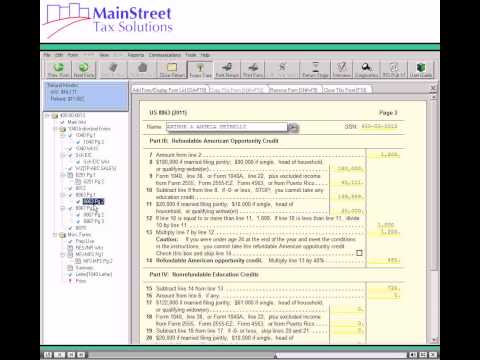

Hello and welcome to our software tutorial series. This tutorial provides an explanation of entry and education credits in the tax software. In this tutorial, you will learn how to enter the American Opportunity Credit and the Lifetime Learning credit in the tax software. Both the American Opportunity Credit and Lifetime Learning credit are entered directly on Form 8863 in the software. From this form, the total allowable credit calculates to Form 1040 or Form 1040a. On Form 8863, both credits require entry of the student's name, social security number, and amount of qualified expenses. Both credits can be claimed on the same tax return but not for the same student. See instructions for Form 8863 or IRS Publication 974 for details on qualifying expenses, eligible students, and who can claim the credits. We will now enter information for the American Opportunity Credit in the tax software. Click on the "Add Form/Display Form List" tab at the top of the active form. Type "8863" in the "Look for Entry" and press enter. In Part 1, American Opportunity Credit, enter the student's first name, last name, their social security number, and the amount of qualified expenses. The amount entered for qualified expenses should not exceed $4,000, even if the student's actual qualified expenses were more. The software calculates the remaining fields and displays the tentative American Opportunity Credit online. The tentative credit amount calculates to Form 8863 page 2, line 7. Part three is calculated by the software to determine the refundable American Opportunity Credit displayed on line 14. If the student was under age 24 at the end of the year and meets the conditions in Form 8863 instructions, then the student cannot take the refundable American Opportunity Credit. If this was the case, we'd mark the check under line thirteen. If...

Award-winning PDF software

1098-c instructions 2025 Form: What You Should Know

Forms 1098-C with your income tax return and file Form 8453. Learn more about how 1098-Cs work through the IRS guide to donating a vehicle ! Donating a Vehicle to a Charitable Organization — Filing Requirements Dec 1, 2025 — Any person who would otherwise have to pay federal Income Tax under the income tax laws for donating a motor vehicle or part thereof, including: • the donor; • a vehicle recipient to a registered tax-exempt nonprofit organization; or • a tax authority, as defined under IRC 6521. • A charitable organization must also file Form 8080B, Certification by a Federal Tax Collector of Individuals that are Exempt from Federal Income Tax by Reason of Their Donations to a Charitable Organization, when it receives a motor vehicle from a non–registered organization. The tax collector must then certify that the value of the motor vehicle is below the value of 500 (the limit for donation by a non-taxpayer to any individual who is eligible to make a tax-deductible contribution to a registered charity). The tax collector must also retain Form 8080B for a period of three years. The IRS provides general information about the IRS form. A donor who is a resident of the U.S. and who meets all the following conditions must: • Make a minimum annual gift of 250.00 to a qualified organization. • Make one or more gifts of a vehicle valued at 40,000.00 or more to a qualified organization. • Donate or give a car or a motorcycle or a boat valued at 30,000.00 or more (depending upon IRS rules). A motor vehicle is a vehicle, or a vehicle part, used primarily to transport property.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1098-C, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1098-C online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1098-C by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1098-C from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1098-c instructions 2025