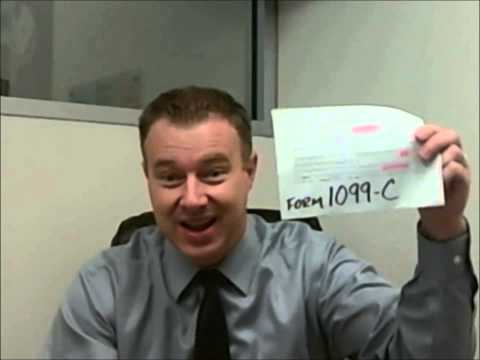

Hello, now that 2012 is over and we are in 2013, many of you have been asking questions about what to do with your 1099 or 1098 tax documents. These documents are sent by lenders if you went through a short sale, foreclosure, or if you bought a house. They look like this: here's a 1099c and here's a 1098. Some of these documents come to our office on your behalf if we have represented you, and we will make sure you receive them. However, some of them may have been sent directly to you, or you may not have received them yet. I want to let you know that we are here to answer all your questions about the 1099c and the 1098, so that you can file your taxes on time and get the maximum refund without any penalties. Banks often make mistakes on these documents, especially the 1099c. You have a couple of options here. If you have any questions about the 1099c or the 1098 that you received, you can click on the links below for the 1099c video or the 1098 video. These videos will provide more detailed information. Alternatively, you can email the document to us by scanning it and sending it to our email address: docs@wellsrealtylaw.com. Please title the email with your last name and "1099c", for example, "Smith1099c". We will get back to you and discuss what you should be concerned about and how to apply the 1099c correctly. If you have any additional questions or concerns, or if you are discussing these matters with your accountant, please have them reach out to us. We have been dealing with various 1099-c and 1098 issues for the past few years, especially during this time of year. Most of the time, there is nothing...

Award-winning PDF software

Video instructions and help with filling out and completing Form 1098-C vs. Form 1098-c